Chase Sapphire Lower Interest Rate

Since a cash out refinance loan may have a longer term than some of the bills you may be.

Chase sapphire lower interest rate. According to the federal reserve board the average interest rate is 15 for all credit cards and 17 for accounts that carry a balance. I got my chase sapphire card today and the ir is 15 24. You can lower your payments by refinancing for a longer time frame like a 30 year fixed loan. Or if you re not planning to stay in your home for more than a few more years you may choose to refinance at a lower interest rate.

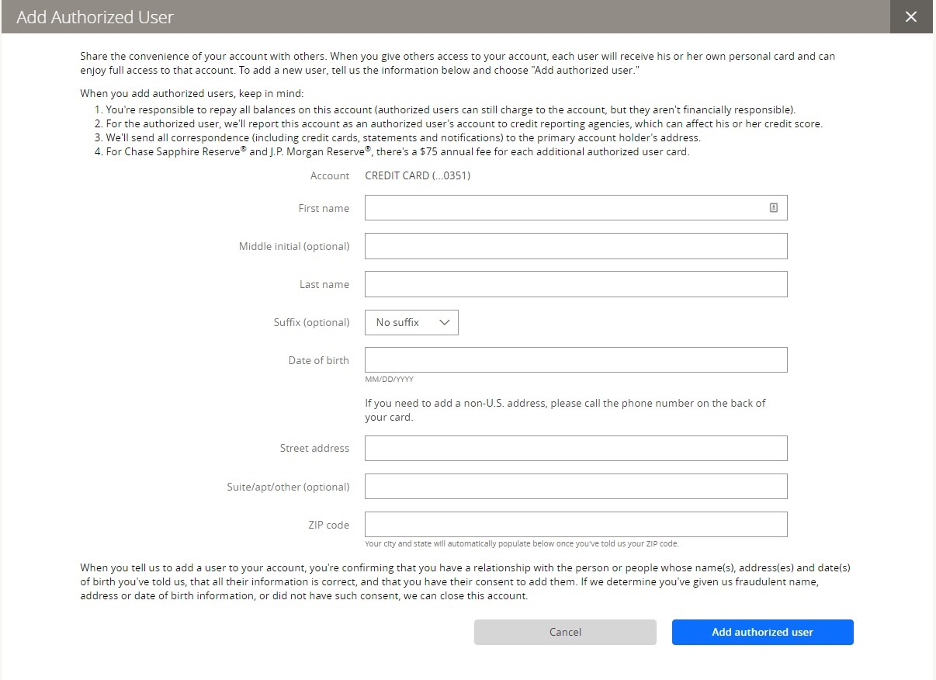

Refinance and lower your interest rate debt consolidation information. We all know that banks are out for profit but they should not be doing this to their loyal customers. Chase jpmorgan jpmorgan chase the. If you find yourself in that boat you may be in luck as chase is currently offering some chase sapphire preferred cardholders lower promotional interest rates.

When i called to activate it i asked the csr about a lower ir but she didn t seem to know much. The amount you save on debt consolidation may vary by loan. Chase sapphire banking vs. Chase sapphire interest rate and credit score questions hi everyone.

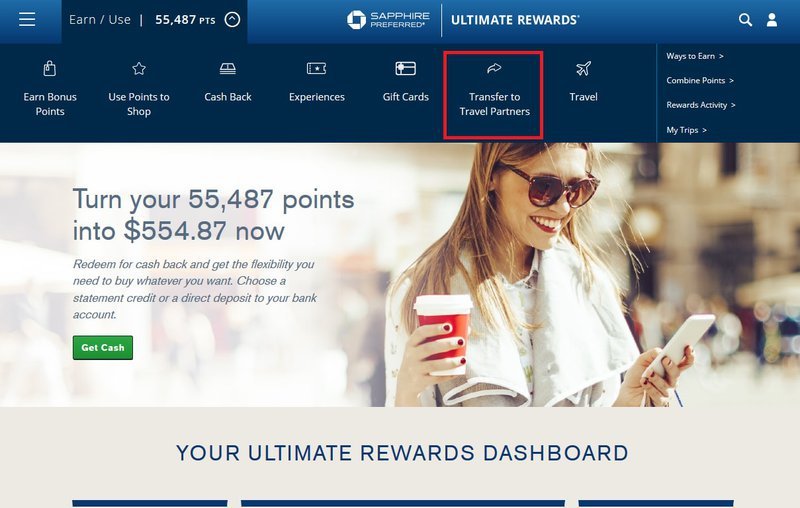

Tpg travel editor melanie lieberman received an email from chase with an offer for a 9 99 promotional apr on all new purchases made between august 1 2019 and jan. Although you ll get a higher apy for higher balances with a bank of america interest checking account it goes only as high as 0 02 which isn t that much better than chase sapphire banking s apy of 0 01. If you d prefer to keep your current card but still want a lower interest rate you may have success contacting your issuer directly and requesting a decrease in your rate. A lower interest rate means more payments go toward bringing down your current balance so you can get out of debt quicker than if you were focused on paying off added interest.

The chase sapphire preferred card is well preferred when it comes to its lower annual fee and apr. Chase sapphire preferred has lower than average purchase aprs. In fact according to one survey your odds are fairly good 69 of surveyed cardholders who asked for a lower rate were able to negotiate a rate reduction with their issuer.

/chase-sapphire-preferred-d8cc6e87e5474245b576947076252332.jpg)