Chase Sapphire Reserve Lower Interest Rate

Rates are effective for 10 01 2020 only and are subject to change without notice.

Chase sapphire reserve lower interest rate. Read on to learn about beneficial introductory offers how to request a lower rate and tips to improve your credit score which can potentially lead to lower rates in the future. To see our current mortgage rates for refinance go to mortgage refinance rates. 30 0 082 2 46 in monthly interest charges. Explore the world and earn premium rewards with chase sapphire reserve.

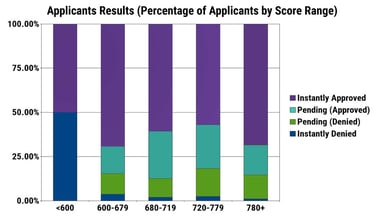

Reports indicate that some chase sapphire reserve cardholders receive initial credit limits between 30 000 and 60 000 but rumors persist of limits as high as half a million dollars. Chase sapphire preferred has lower than average purchase aprs. Interest is compounded and credited monthly based on the daily collected balance. Interest rates are variable and determined daily at chase s discretion.

Web site rates are generally updated each business day in the morning and rates may vary by market. Savings accounts and certificate of deposit accounts are fdic insured up to the maximum amount allowed by law. Apply for a 0 percent interest credit card today. Credit cards mortgages commercial banking auto loans.

Get a mortgage low down payment mortgage jumbo. A lower interest rate means more payments go toward bringing down your current balance so you can get out of debt quicker than if you were focused on paying off added interest. Add what you owe in interest to your purchases for the month. Chase offers low interest credit cards with an introductory 0 percent apr that can save you money when you transfer your balances.

Combine your daily interest amounts into a monthly total. A more realistic option for many consumers is to find a way to lower your credit card interest rate perhaps using one of these methods. The interest rate table below is updated daily monday through friday to give you the most current purchase rates when choosing a home loan. By way of comparison the chase sapphire reserve has a minimum credit limit of 5 000 and only 10 of cardholders have credit limits exceeding 20 000.

According to the federal reserve board the average interest rate is 15 for all credit cards and 17 for accounts that carry a balance. Multiply the daily interest amount 8 2 cents by the number of days in the statement cycle 30 days. Use our mortgage calculator to get a customized estimate of your mortgage rate and monthly payment.