Chase Sapphire Balance Transfer Checks

Purchases do not include balance transfers cash advances travelers checks foreign currency money orders wire transfers or similar cash like transactions lottery tickets.

Chase sapphire balance transfer checks. See our chase total checking. Compare chase checking accounts and select the one that best fits your needs. To receive the chase sapphire banking bonus. No fee during the first 60 days after you open the card after that the fee is 5 or 5 percent of the amount transferred whichever is greater.

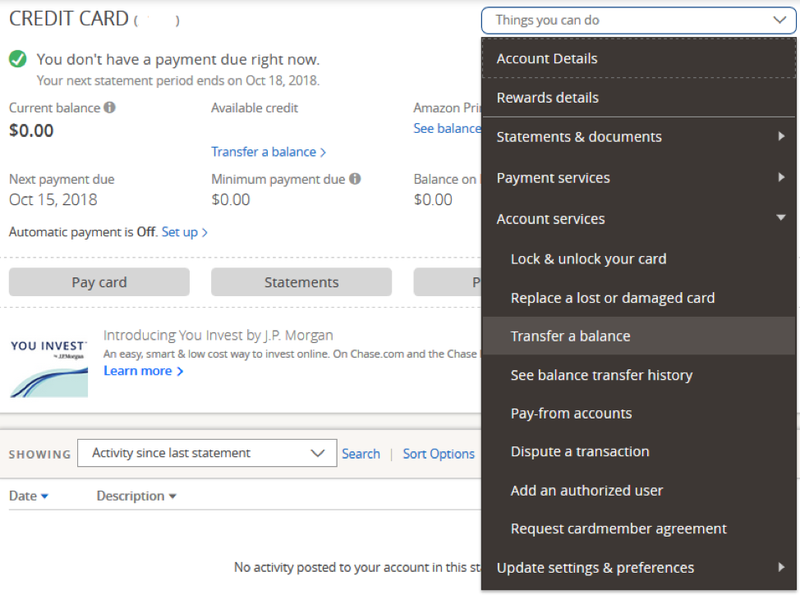

Transfer the amount listed in your offer or more in qualifying new money or securities to a combination of eligible checking savings and or investment accounts excludes insurance products fixed and variable annuities 529 college savings plans any retirement accounts including but not limited to. Chase offers three options for consumers who want to transfer an existing balance. Transfer a balance now pay off higher rate credit cards consolidate your balances simplify your finances. Most cards charge a balance transfer fee of 3 5.

Chase online lets you manage your chase accounts view statements monitor activity pay bills or transfer funds securely from one central place. Higher atm and purchase limits with your sapphire banking debit card 5. Apply for a sapphire preferred travel credit card today. In our opinion this is one of the best balance transfer cards on the market.

No wire transfer fees 6 or stop payment fees. Chase sapphire preferred is the rewards travel credit card that awards you 2x points on travel and dining. Successful payment history must be established for checking accounts you wish to use for transfers. Everyday banking without fees.

Expired chase sapphire checking 1 000 cash bonus. This means if you transfer a balance of 3 000 the transfer fee itself would be 90 150. Chase balance transfer offers. You can save this with the chase slate especially if you have a large balance to transfer.

Open or update to chase sapphire checking. If you ve received balance transfer checks you can use them to pay for things you need or to get cash. No chase foreign exchange rate adjustment fees on atm withdrawals or debit card purchases made outside the u s. If you have questions or concerns please contact us through chase customer service or let us know about chase complaints and feedback.

Enjoy a 1 000 checking bonus when you join chase sapphire sm banking within 45 days transfer a total of 75 000 or more in qualifying new money or securities to a combination of eligible checking savings and or investment accounts and maintain the balance for at least 90 days. Learn about the benefits of a chase checking account online. Transfer a balance now.